INDUSTRY TRENDS REPORT

2023

OUTLOOK

The Impact of Age and Mental Health on Claims

It’s well-established that physical, psychological and social factors can impact injury recovery. We’re currently seeing an aging employee population and a higher prevalence of depression and anxiety reported by claimants since the start of the COVID-19 health pandemic. During this time, we’ve also seen lower rates of surgery and a decrease of opioid utilization.

These trends typically result in higher use of physical therapy, thus increasing physical medicine’s share of the work comp medical dollar, but contributing to lower claims costs and better claims outcomes. We expect conservative care initiatives, which include the use of physical therapy, to continue in the future to have a long-term positive impact on claims.

Jump to Articles

Impact of Injured Employee Age on Physical Recovery

Conventional wisdom tells us that the body takes longer to heal the older we are, and so it may not come as a surprise that the injured employee’s age has an impact on physical recovery. While older employees get injured less frequently, they often suffer more severe injuries and have longer recovery times. With an aging workplace, it becomes increasingly more important for employers to take necessary measures to prevent injuries among the older workforce.

According to the Bureau of Labor Statistics

39%

of the U.S. workforce is expected to be older than 55 in 20261

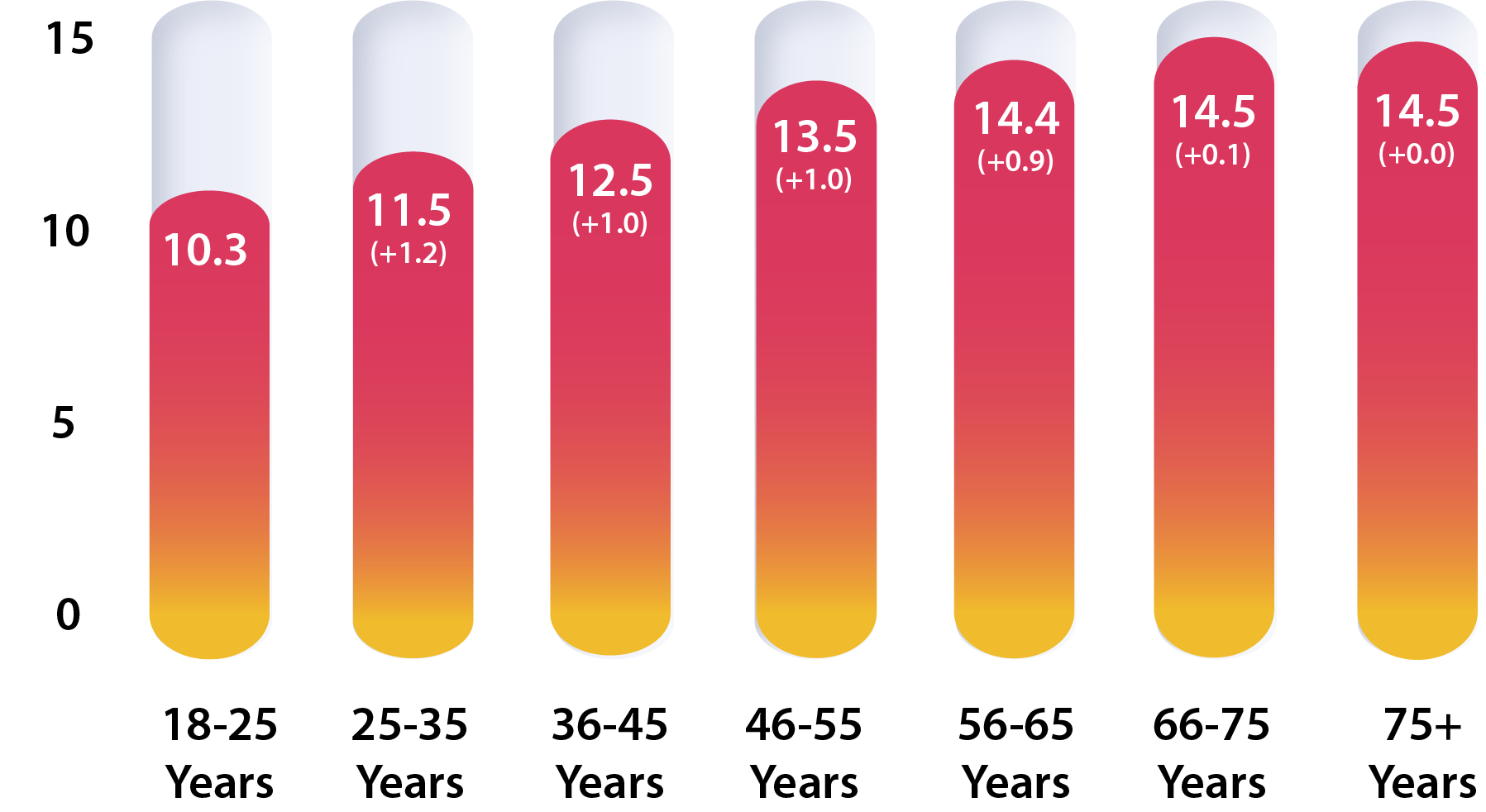

Total PT visits increase by injured employee age.

Across all injury types, MedRisk found that the number of PT visits attended by injured employees increases by about one full visit with each age group up through the 55-65 age bracket where average visits per episode of care remains consistent through the older population.

Total PT Visits by Age – All Claims

Injured employees aged 56-75+ have

21%

more PT visits than those aged 18-55+

Key Takeaway:

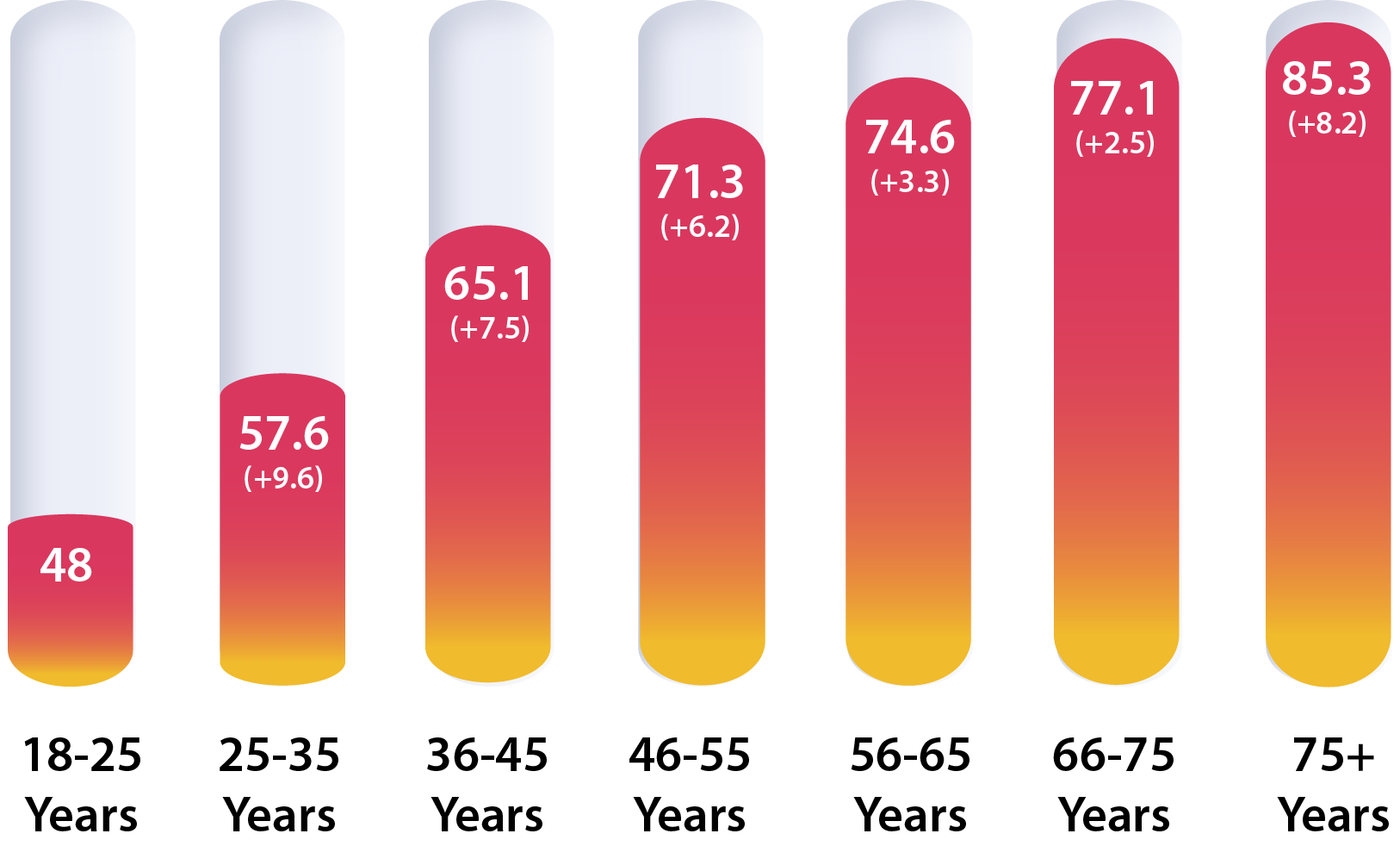

Injured employees aged 56-75+ have

31%

longer duration than those aged 18-55+

Injured employee age affects PT duration

As you might expect, MedRisk found that as the average number of PT visits increases by age bracket, so, too, does duration. However, while the number of visits remains fairly static in the higher age brackets, duration continues to increase with age. Although injured employees may not be treating for more visits, they are treating for longer.

Impact of Mental Health and Physical Recovery

In workers’ compensation claims, mental health conditions can delay a worker’s recovery and return to work and increase medical costs. Stress, anxiety and depression are among the most prevalent for injured workers. While an unexpected injury can manifest behavioral health concerns, so too can outside factors unrelated to the injury. Across the United States and the rest of the world, rates of anxiety and depression have increased because of the COVID-19 health pandemic. With mental health conditions rising, it’s important for claims organizations to take proactive steps to identify and manage psychosocial health conditions to help improve recovery outcomes for injured employees.

1 in 5

Americans suffer from a mental health condition that impacts their daily life at any given time2

50%

or more injured employees experience clinically-related depressive symptoms at some point, especially during the first month after the injury3

25%

Increase in the prevalence of anxiety and depression worldwide as a result of COVID-19 pandemic4

Increased rates of anxiety and depression in injured employees.

Consistent with the increased prevalence of anxiety and depression in the general population, MedRisk found that injured employees self-reporting anxiety and depression also increased since the start of the COVID-19 health pandemic. Injured employees reporting anxiety and/or depression jumped significantly between 2019 and 2020 and has not returned to pre-pandemic rates even in 2022.

Injured employees reporting anxiety and depression have

7%

higher utilization than those who did not report these conditions

Impact of anxiety and depression on utilization.

Biopsychosocial medical models suggest that an injured employee’s recovery is not just impacted by their physical condition but by additional factors, including psychiatric illnesses. To determine the impact of claims with reported anxiety and/or depression, MedRisk compared those claims against cases where these conditions were not reported. Perhaps not surprisingly, claims with reported anxiety and depression have a seven percent higher rate of utilization for PT services.

Other Market Trends

Surgery Rates Continue to Decline

Research has demonstrated that conservative care initiatives, such as the use of physical exercise, improves back and joint pain far more effectively than expensive surgeries. Similarly, use of injections can lead to short-term pain relief but mask the problem rather than addressing it. Physical therapy has become a widely accepted critical conservative care recommendation, reducing the need for more invasive procedures and opioid prescriptions. In 2022, MedRisk continued to see a lower rate of surgery on claims involving PT, a positive trend for claim costs and outcomes.

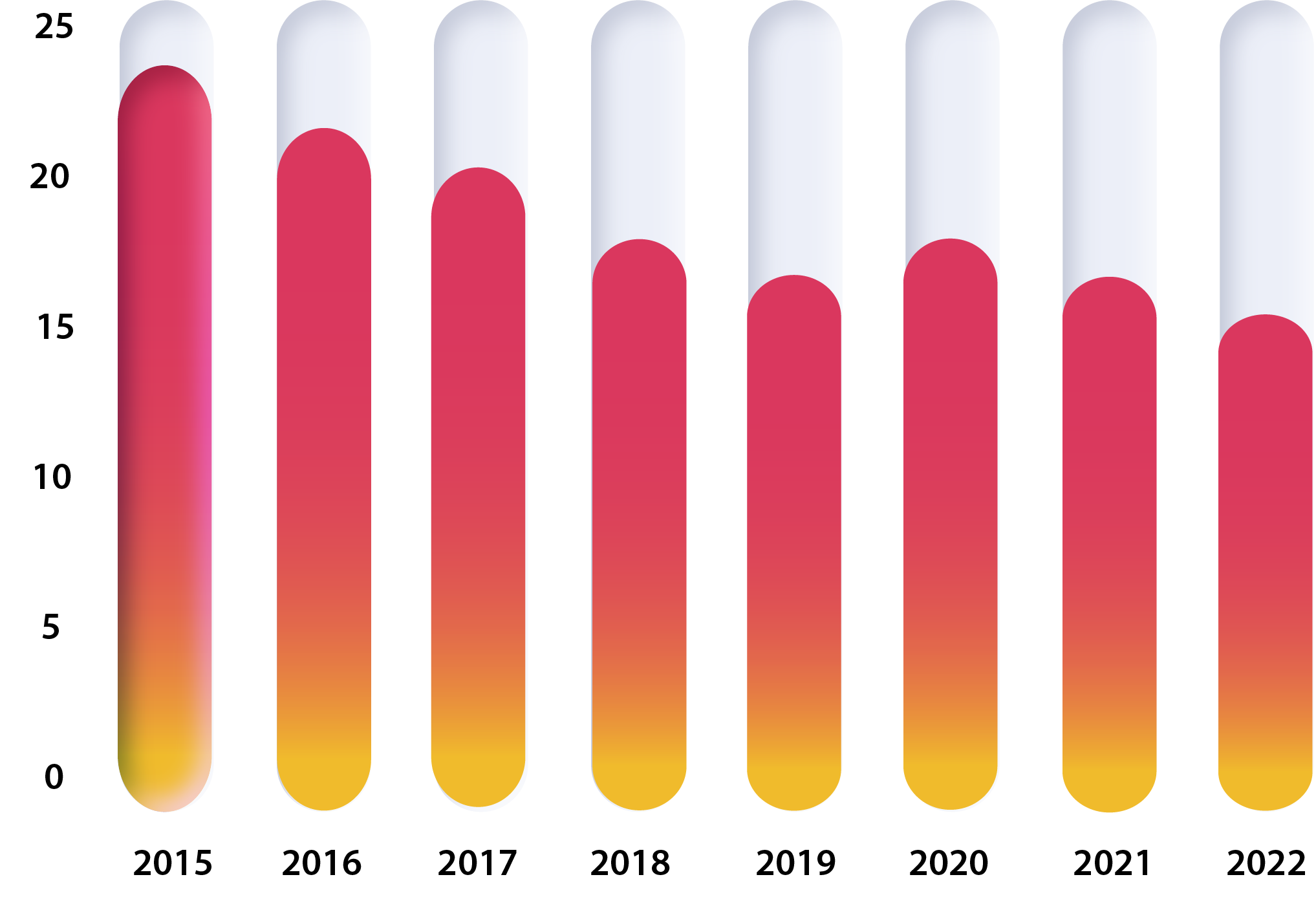

Percent of Claims Involving PT with Surgery

Prior to the coronavirus health pandemic, rates of surgery were already declining, with nearly one quarter of all claims involving PT receiving surgery in 2015 compared to just 16% in 2022.

2020 was an anomaly with the rate of surgery increasing slightly, but this is likely attributable to a rebound of surgeries from those delayed in 2019 at the start of the pandemic.

Top Diagnosis Codes

According to the National Safety Council, overexertion and bodily reaction is the second leading nonfatal injury or illness event involving days away from work, ranking only behind exposure to harmful substances or environment. Overexertion injuries, which commonly involve PT, include those stemming from lifting, pushing, pulling, holding, carrying or throwing an object.

MedRisk has seen little variation in the distribution of diagnosis codes with PT involvement over the years.

Five diagnosis codes represent

26%

of all claims with PT involvement

MedRisk By the Numbers

MedRisk is the leading provider of managed physical medicine for the workers’ compensation industry and related market sectors. The patients we serve are never just a number – each person has a care path tailored to their exact needs.

While we provide individual care to over half a million patients each year, we also measure our outcomes in aggregate so we can report on our results and trends. Here’s a closer look at MedRisk based on 2022 data:

Injured Workers Treated by MedRisk Providers

Total Network Providers In MedRisk Network

%

of Workers’ Comp Payers Choose MedRisk for Managed PT Services

%

of Clinical Reviews had a MedRisk Recommendation of Reduce Visits

Location and service type identification requirements for WCN participating providers have been made much more specific.

Networks must give prior notice to TDI of any proposed change of ownership.

Networks must give prior notice to TDI regarding modifications to network configurations involving telehealth services.

Network contracts and subcontracts with providers must include a statement that a carrier contesting compensability may not deny payment prior to the issuance of a notice that the injury was not compensable.

Carriers and employers must have a documented procedure for determining which is responsible for obtaining signed employee acknowledgements of the employer’s network participation as well as signed copies of the employee acknowledgements.

By September 23, 2022, networks must have a documented credentialing process that meets NCQA or URAC standards.

Networks may only use Texas-licensed doctors to perform in-network utilization reviews.

Implications: Payers, certified WCNs and specialty networks should review their policies and procedures in preparation for TDI’s enforcement efforts based on these proposed regulations.

Implications: This legislation can be seen as part of a continuing discussion in California regarding the function and value of registered Medical Provider Networks (MPNs) in delivering timely and accessible health care to injured workers. It is generally recognized in the workers’ compensation community that prompt delivery of health care services improves work-related injury outcomes and independent research has shown this to be the case.

Implications: The provisions of the model act offer a guidepost for payers’ internally developed cybersecurity standards since they are now broadly required by state law. Fortunately, they are reasonable, requiring payers to develop and implement a data security program to identify and protect against risks, respond to data incidents and investigate and disclose cybersecurity events to regulatory authorities and affected consumers and trading partners. Payers are also required to oversee compliance of their third-party service providers using or accessing the payer’s confidential information.

Telehealth

Telehealth Compliance with HIPAA: The Office of Civil Rights (OCR) within the US Department of Health and Services has recently issued guidance broadly endorsing the use of audio-only telehealth services to increase access to health services by patients who have limited financial resources or who live in rural areas with limited broadband availability. The guidance can be found here: https://www.hhs.gov/hipaa/for-professionals/privacy/guidance/hipaa-audio-telehealth/index.html.

Implications: OCR enforces federal privacy regulations (e.g., HIPAA) that generally don’t apply to WC payers, but health care providers and payers’ third-party service providers don’t enjoy those same exemptions, so this clarification comes as a welcome relaxation of regulatory constraints. On a related telehealth topic, a new study from physical therapy quality analytics firm Focus on Therapeutic Outcomes (FOTO) found that, for telerehabilitation for low back pain, telerehab (a) was equally effective in improving functional status outcomes for patients with low back pain compared to traditional in-person office visits, (b) usually involved significantly fewer visits, and (c) had roughly equal patient satisfaction ratings (82% for telerehab versus 86% for in-person office visits.

The employee’s injury or disability arises out of the employee’s employment.

The employee’s employment necessarily exposes the employee to conditions that substantially contribute to the risk of injury.

The injury or disability is sustained in the course of activity that is taken on by the employee for the exclusive benefit of the employer.

Implications: With a substantial proportion of the workforce working remotely and likely not returning to the office fulltime, legislatures are grappling with work-relatedness issues that at one time were self-evident, or at least settled law. WC stakeholders can expect lawmakers, regulators and jurists to continue to address these questions for the foreseeable future. The Ohio statute became effective on September 23, 2022.

Major State Privacy Legislation: On January 2, 2023, the Wall Street Journal reported that many new state laws in the coming year would focus on consumer data privacy. Nearly two years ago we noted that California and Virginia had enacted new and comprehensive privacy statutes, both becoming effective on January 1, 2023. The California Privacy Rights and Enforcement Act (CPRA) expands upon the current California privacy statute, the California Consumer Privacy Act (CCPA), by regulating not only the buying and selling of consumer information, but also its “sharing.” This term, while appearing to be broad, actually is narrowly defined as targeted advertising based on the consumer’s personal information. The focus of California’s privacy protection measures was and continues to be on commercial use of consumers’ personal information for sales and marketing purposes. The Virginia Consumer Data Protection Act (CDPA) takes a different approach to consumer privacy, following many of the concepts found in the European Union’s General Data Protection Regulation (GDPR). A business that determines the purpose and means of processing personal data (a “controller”) may collect and use this information for only specific purposes, must allow a consumer to access and in many cases to delete the data, and is responsible for compliance of third party “processors” acting on its behalf. There are a number of thresholds and exemptions that will relieve most workers’ compensation payers and their service providers from CDPA compliance obligations. Of more relevance to the workers’ compensation industry is the NAIC Insurance Data Security Model Law, which has now been enacted, in whole or part, in 21 jurisdictions. Similar in many ways to the New York’s Cybersecurity Requirements for Financial Services Companies (NYCCR §500), the Model Law establishes a comprehensive regulatory framework applying to claim payers and protecting the non-public data of insurance “consumers,” including claimants. Key features of the Model Law include the following:

Defines “consumers” to include claimants as well as applicants, policyholders and insureds.

Defines a “cybersecurity event” to include both data loss or misuse and access to, disruption or misuse of, an information system.

Defines “licensees” subject to the law to include all entities licensed or registered under the state’s insurance laws.

Defines protected “nonpublic information” to include both personally identifiable information and licensees’ sensitive business information.

Requires licensees to develop and implement a comprehensive information security program, including a written incident response plan, which identifies and mitigates against reasonably foreseeable internal or external threats.

Requires licensees to annually certify their compliance to their domiciliary insurance regulator.

Requires licensees to promptly investigate and, if confirmed, remediate any suspected cybersecurity event, notifying regulatory authorities within 72 hours of discovery.

Requires licensees to follow applicable state data breach laws notifying consumers of an incident.

Requires licensees to oversee their third party service providers’ compliance with information security laws and to take responsibility for managing their third party service providers’ cybersecurity events.

Implications: All business entities participating in adopting states’ workers’ compensation systems are either directly or indirectly subject to the Model Law, so it is important that payers and their trading partners establish a comprehensive information security program complying with the Model Law. Further, because the Model Law has not been enacted in every jurisdiction and has been enacted with important revisions in others, it is important to review the relevant statute for key variances. For example, the Maryland statute, effective October 1, 2022, applies specifically to third party administrators as well as insurers, but this clarifying provision does not appear in the NAIC Model Law.

Prior Trends Reports

2023

2022

2021

2019

2018

2017

1U.S. Bureau of Labor Statistics. Monthly Labor Review.

2Centers for Disease Control and Prevention. About Mental Health.

3Kim, Jaeyoung. Depression as Psychosocial Consequence of Occupational Injury in the US Working Population: Findings from the Medical Expenditure Panel Survey. National Library of Medicine. 2013 Apr 5.

4COVID-19 Pandemic Triggers 25% Increase in Prevalence of Anxiety and Depression Worldwide. World Health Organization.